Tax exemption is not all that it is cracked up to be without the tax deductible donation. If you are a non-profit organization, what is there to tax, being that there are no profits/income?

That's a bit of a misconception. A 501(c)(4) can be profitable. What it can't do is give a return to an individual investor. It can, however, have employees, who earn a salary, and it can pay money for services from other businesses, which are supposed to be at fair market value, but which the IRS can't really keep very close tabs on and can be with organizations closely associated with the 501(c)(4). So, there are ways of getting money out of the thing. Just not the normal investment ways.

All the money paid to personnel, when they are paid, gets taxed as wages.

If I were to personally hire a employee, using my personal post-tax income, I would pay, in addition, various taxes (payroll taxes, unemployement, etc.) related to the employment. A 501(c)(4) would pay the payroll taxes, but would not pay the tax that I paid on earning the money, nor any equivalent tax such as might be imposed on a business or other fictitious entity. It is thus tax privileged.

All the money spent on political advertisements gets counted as taxable revenue to the advertising agency.

That's someone else's taxes, because it's the income of whoever they paid for the advertisement. If I took out an advertisement, I would pay taxes on the money I used for that purpose.

The money is taxed once it is spent.

That's generally a tax on someone else's income and/or a sales tax. Most of the places that I spend money end up paying taxes on it despite the fact that I was already taxed on it when I earned it.

If you and I want to open a joint bank account together, should we be taxed on the money that is deposited into the account?

That depends on how we structure the account. If we merely put our two names on it, no, not generally, although potentially if it were a large cash transfer it could be taxed as a gift over the annual exclusion (

http://www.irs.gov/Businesses/Small...oyed/Frequently-Asked-Questions-on-Gift-Taxes). However, if we set up a legal entity with a separate legal existence, then it could be taxed in some form. How exactly that occurs depends on how we set it up.

Of course not. Similarly, if a hundred people want to put their money into a joint "Super PAC" bank account, that money shouldn't be taxed when it is put into the account, either.

That's not really what's happening, though.

Only the tax deduction on the donation is relevant due to the joint bank account analogy discussed above.

I think you're mistaken there. Why do you think organizations categorize themselves as 501(c)(4)? It's not compulsory.

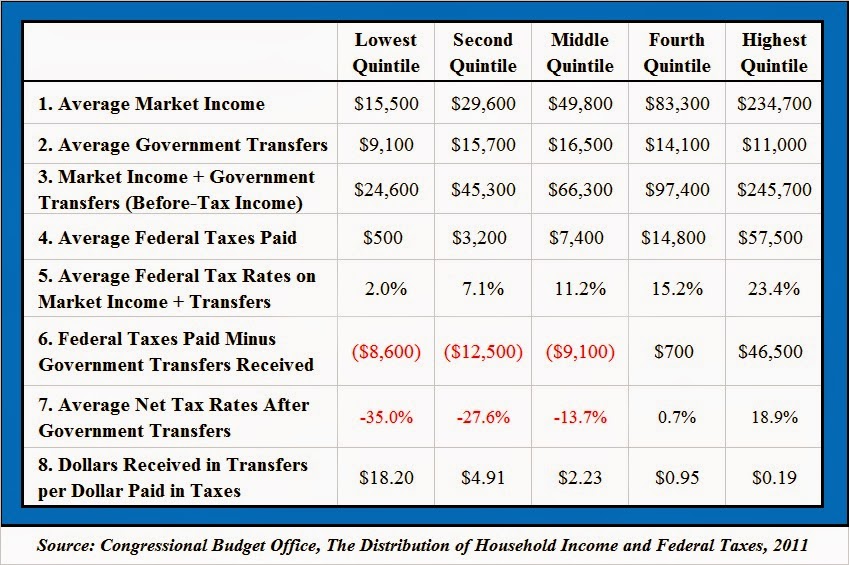

By the way, the poor receive far more government transfers than they have to pay in tax:

Well, without a real citation, I can't dig into it too deeply, but what I can tell you is that when I was earning in those second and third quintiles, I certainly wasn't making money off of the tax code. Many of the people who are likely in that category aren't poor at all, but retirees, disabled people, and the unemployed receiving government benefits like Social Security and unemployment, which they have earned.

https://www.cbo.gov/publication/49440

And this is only some of the tax that poor people end up paying.