Lefties think controlling humans is essential to progress and that turning them into zombies works best.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

conspiracy theories

- Thread starter way 2 go

- Start date

I drench mine with GMO mRNA-infused salad dressing. Delicious!Truly a disgusting move.

Sadly, thousands of well-meaning people desiring to be good conformists to government ideals and policies have lost their lives due to bad policies forced on them by deluded government officials.I drench mine with GMO mRNA-infused salad dressing. Delicious!

That's what happens to sheep.Sadly, thousands of well-meaning people desiring to be good conformists to government ideals and policies have lost their lives due to bad policies forced on them by deluded government officials.

way 2 go

Well-known member

.Pranksters Vovan and Lexus posing as Zelensky tricked ECB President Christine Lagarde into disclosing her plan to launch a "Digital Euro" in October that will give central banks control over how citizens can spend money: "There will be control. You’re right. You’re completely right. We are considering whether for very small amounts, you know, anything that is around 300, 400 €, we could have a mechanism where there is zero control. But that could be dangerous... I don’t want Europe to be dependent on an unfriendly country’s currency, for instance, you know, the Chinese currency, the Russian currency... I don’t want Meta, Google, or Amazon to suddenly come up with a currency that would take over the sovereignty of Europe." Central bank digital currencies are the latest battleground in the ongoing struggle for individual liberties. Without global awareness, central banks will pull off a massive violation of human rights, and citizens will cheer them on while they do it.

Prank with the President of the European Central Bank Christine Lagarde

Full video prank with European Central Bank President Christine Lagarde In a conversation with our "Zelensky", Ms. Lagarde complained that sanctions against Russia had failed, and praised Nabiullina f

Last edited:

way 2 go

Well-known member

Central Bank Digital Currencies are the Bullet Train to Digital Concentration Camps

“If you can move every human into a digital concentration camp, empty their bank account any time you want, and tell them what they can and cannot spend money on, you've got complete control."

The White House published a "comprehensive framework" on Friday attacking decentralized cryptocurrencies while promoting a U.S. government-controlled programmable Central Bank Digital Currency (CBDC), per an official press release.

Agencies that were chosen to lead the ongoing working group for the research and possible development of a CBDC include the Federal Reserve, the National Economic Council, the National Security Council, the Office of Science and Technology Policy, and the Treasury Department.

CBDCs are digital currency issued directly from a nation-state’s central bank and serve as legal tender.

Critically, CBDCs are controlled by governments and therefore represent the polar opposite of the ideas — decentralization, open-source software, permissionless, peer-to-peer transactions — that made Bitcoin and other cryptocurrencies such a revolutionary technology.

As you can guess, CBDCs will be tied to user identities and Digital IDs, which will allow for total surveillance by the State and eliminate any chance of financial privacy.

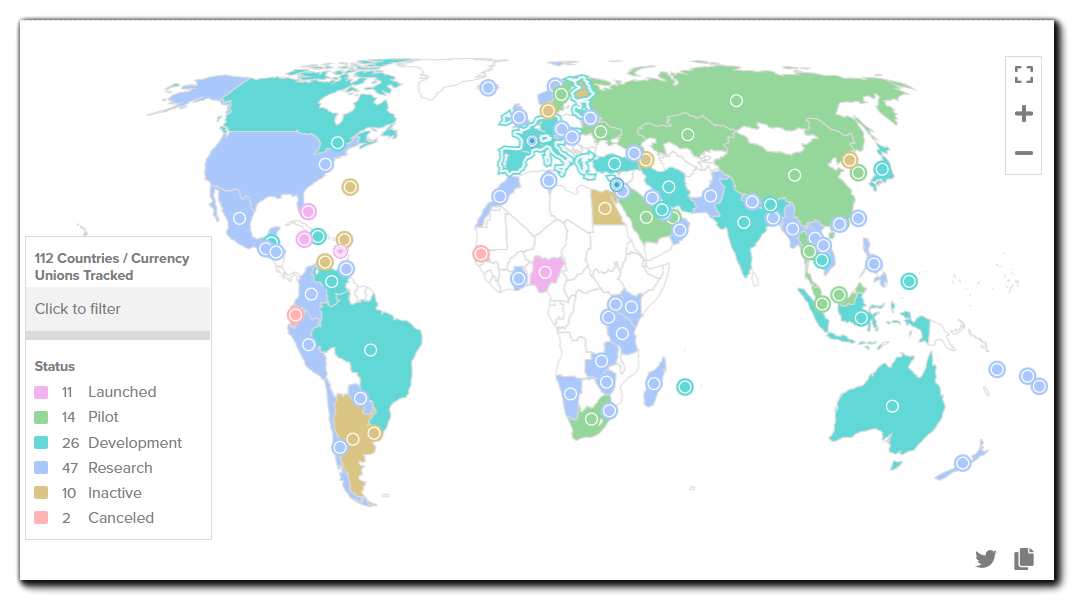

According to the Atlantic Council’s Central Bank Digital Currency Tracker, 112 countries, representing over 95 percent of global GDP, are exploring a CBDC.

11 countries have already launched a digital currency including Nigeria and numerous Caribbean nations.

14 countries are testing pilot programs including South Korea, Thailand, Saudi Arabia, Sweden, and China which is set to expand its use of the Digital Yuan in 2023.

“These central bankers will be able to see what is in your bank account, who you transact with, what you purchase, and anything else they are curious about in your financial life,” he wrote.

“That full transparency with the state removes all elements of privacy, while also giving the institutions the ability to censor any and all transactions, regardless of whether they have a legitimate reason or not.”

For example, China’s Digital Yuan can be programmed to be activated on a certain date, programmed to expire on a certain date, programmed to be only valid for certain purchases, and ominously, programmed to be only available to citizens who meet certain pre-conditions.

Central banks can thus influence and control the behavior of the recipients of this centralized digital currency, as well as exclude those who they want to penalize from participating in the financial system.

These CBDCs would be linked to Digital IDs, which would be linked to vaccine passports, carbon footprints, and a social credit system similar to the one being implemented in China.

Last edited:

mRNA in your vegetables also. Not just beef.

way 2 go

Well-known member

mRNA in your vegetables also. Not just beef.

way 2 go

Well-known member

way 2 go

Well-known member

The Fed just announced it will introduce its “FedNow” Central Bank Digital Currency (CBDC) in July. CBDCs grease the slippery slope to financial slavery and political tyranny. While cash transactions are anonymous, a #CBDC will allow the government to surveil all our private financial affairs. The central bank will have the power to enforce dollar limits on our transactions restricting where you can send money, where you can spend it, and when money expires. A CBDC tied to digital ID and social credit score will allow the government to freeze your assets or limit your spending to approved vendors if you fail to comply with arbitrary diktats, i.e. vaccine mandates. The Fed will initially limit its CBDC to interbank transactions but we should not be blind to the obvious danger that this is the first step in banning and seizing bitcoin as the Treasury did with gold 90 years ago today in 1933. Watch as governments, which never let a good crisis go to waste, use Covid-19 and the banking crisis to usher in a new wave of CBDCs as a safe haven from germ-laden paper currencies or as protection against bank runs.