I thought this was an interesting article.

http://www.nationalreview.com/article/453468/economic-inequality-crony-capitalism-conservatives

The Conservative Inequality Paradox

Are conservatives focusing on the wrong things? Is the inequality we see really a result of fair market distribution?

http://www.nationalreview.com/article/453468/economic-inequality-crony-capitalism-conservatives

The Conservative Inequality Paradox

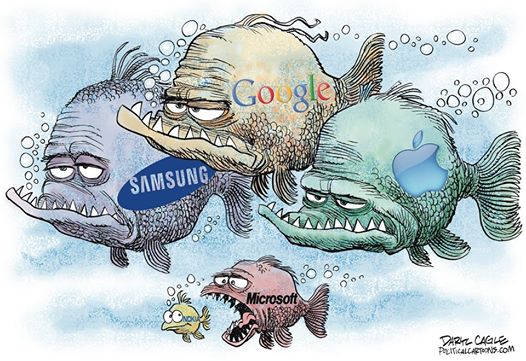

| Yes, the game is rigged for the rich. Conservatives have two intellectual commitments that are increasingly incompatible. They believe that the American economy is clogged up with crony-capitalist corruption that hands out special favors and protections to organized interests. They also hold that economic inequality — in particular, the surging share of total income earned by those at the very top — is morally justified by the rights of property and the tendency of free markets to raise living standards overall. These two commitments can no longer be squared. If our economy really is riddled with cronyism, then the beneficiaries must have pocketed large amounts of ill-gotten loot. The existing distribution of income and wealth, therefore, does not deserve the deference it would be due if all gains were derived from spontaneous, unregulated market transactions. Call it the conservative inequality paradox: Either conservatives have overstated the amount of crony capitalism, or their dismissal of the concept of inequality as envy is misplaced. .... If anything, conservatives have been too modest in their assessment of the breadth and scope of crony capitalism. In our book, we focus on four big case studies: financial regulation, patent and copyright law, occupational licensing, and zoning. In all of them, government-caused market distortions have been growing rapidly over recent decades. Between 1980 and 2006, the financial sector as a percentage of GDP grew by almost 70 percent, fed by regulatory subsidies for securitized mortgages and a string of “too big to fail” bailouts. Copyright terms have lengthened from a maximum of 56 years to the current life of the author plus 70 years, while laxer standards for patentability have caused a nearly 400 percent increase in the number of patents awarded annually. This excessive expansion has created a field day for lawyers and inflated profits for Hollywood, big pharma, and Silicon Valley with higher prices and licensing fees. But new innovators faced with traversing this legal minefield are not so fortunate. ... Conservative attitudes on inequality have long been shaped by Robert Nozick’s famous metaphor of the basketball player Wilt Chamberlain. Nozick argued that Chamberlain’s high income was derived from mutually beneficial exchange and was therefore justifiable. Who could say that there was anything unfair about a basketball player trading his skills for the money of fans? And how could a distribution of income produced by that sort of mutual exchange be unfair? But the Wilt Chamberlain metaphor does not apply to an economy characterized by extensive high-end rent-seeking. Even if you believe that market returns are inherently just and therefore worthy of being defended on ethical grounds, how do you justify windfalls that are a function of distorted rules of the game? The answer is you can’t. In the best of all worlds, conservatives would respond to this state of affairs by attacking rent-derived inequality at its source. Their economic agenda would focus on curtailing subsidies for finance, excessive protection of intellectual property, the licensing of high-end professionals, and overly restrictive land-use regulation. Doing so wouldn’t require conservatives to become crusading egalitarians, as these reforms would also unleash economic dynamism, innovation, and growth — familiar conservative priorities. Nevertheless, making regressive regulation a conservative priority would be a distinct change in approach. Too often, conservatives’ idea of a pro-growth policy agenda starts and ends with tax cuts, despite the overwhelming evidence that moderate increases or decreases in the top rate have little effect on growth. When conservatives do turn their attention to regulation, they usually think about providing “regulatory relief” for business by lightening health, safety, environmental, and labor regulations. In our view, though, the regulations with the most pernicious economic effects are the ones that subsidize business by blocking competition or by otherwise distorting markets. ... That leaves a hard question, namely, how conservatives should think about inequality in a fallen, second-best world in which so many of these rents survive. At a minimum, there’s a strong case for reconsidering the conservative obsession with reducing top marginal income-tax rates. For too long, conservatives have overhyped the growth effects of tax cuts, as well as the dubious “starve the beast” theory according to which members of Congress would respond to tax cuts by restraining government spending. Many conservatives did not look carefully at the evidence behind these dodgy empirical claims because they believed that they held the moral trump card: By cutting taxes, they were returning wealth to its rightful owners. But in the “captured economy” we’re currently living in, this belief is due for reexamination. Not only is a significant fraction of the rich’s income morally tainted by government favoritism, but it is also used to fund yet more rounds of regressive rent-seeking. One way to begin solving this problem would be to build a veritable bonfire of the deductions that the wealthy use to shield their income from taxation. The exclusion from taxes of employer-paid health insurance, retirement savings through 401(k)s and IRAs, and education savings accounts could either be scrapped or converted into refundable tax credits. We could also consider a financial-transaction tax, which could raise a lot of revenue while also reducing the incentives for excessive trading of assets. Changes such as these would allow us to claw back some of the rents at the top of the economy without increasing the marginal income-tax rates that conservatives are so concerned with. If conservatives took seriously the presence of ill-gotten gains at the top of the income spectrum, they might also look at immigration policy in a new light. Over the past few decades, the United States has exposed those at the bottom of the economic pile to intense global competition, whether in the form of products from China or workers from Mexico. As Dean Baker has argued, it is high time to expose the wealthy to those same bracing forces of competition by opening up the economy to more high-skilled immigrants, especially in protected professions such as medicine and dentistry. Conservatives need to face and resolve their inequality paradox. They must double down on their principled advocacy of free, competitive markets — while taking a few giant steps back from the assumption that large incomes reflect large contributions to the general welfare. Read more at: http://www.nationalreview.com/article/453468/economic-inequality-crony-capitalism-conservatives |

Are conservatives focusing on the wrong things? Is the inequality we see really a result of fair market distribution?